Responses underscore need for better healthcare payment options to relieve financial pressures and improve the patient experience

CHARLOTTE, N.C. – Nov. 28, 2023 – Seventy-two percent of consumers can’t or don’t pay their healthcare bills immediately, according to a recent survey commissioned by AccessOne, a leading provider of consumer-centric patient payment tools and financing options. Among those who wait to pay, 68% say it’s because they can’t afford to pay their bills on time.

Now, healthcare revenue cycle leaders must consider how to better serve patients who need different options and support to manage the cost of their care.

Conducted by Big Village, the survey asked more than 1,000 American adults about their healthcare spending, how they currently pay their medical bills and what they want in terms of payment options from their providers. Key findings include:

- Four out of 10 respondents say they’ve experienced an increase in healthcare costs. Notably, almost half of respondents (48%) have taken some kind of action to reduce medical expenses, including postponing care or opting not to fill prescriptions.

- Nearly one-third of consumers say they are “not confident at all” they could pay a medical bill of $500 or more. While some individuals dip into personal savings to handle their bills when their income isn’t sufficient, as many as 32% use a personal credit card.

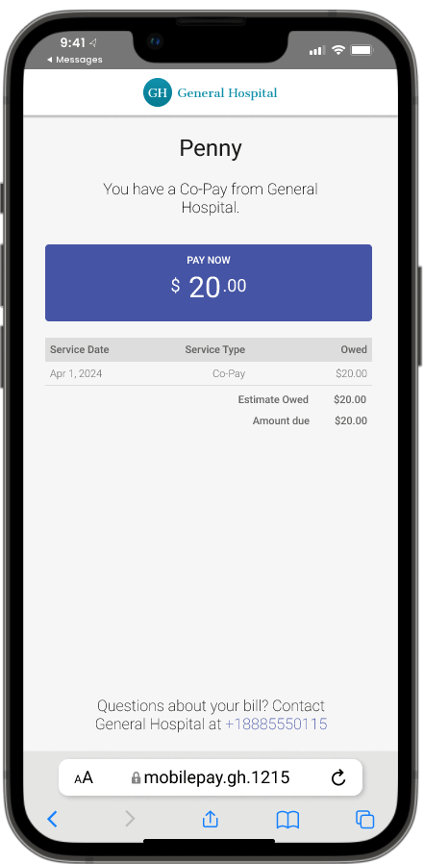

- More than half of respondents prefer digital communications regarding bill pay. Notably, about 30% of Gen Z respondents and 22% of millennials specifically prefer secure text messages.

Survey findings underscore why it is imperative that health systems assess whether they are providing the best payment options to their patients—and how those options directly impact access to care, the patient experience and the organization’s financial health.

“Consumer satisfaction and loyalty is increasingly tied to the patients’ financial experience with their providers. Providers with transparent and affordable repayment options are winning share in a market where short-term banking trends are squeezing credit access and long-term benefit design trends push more and more cost to the consumer,” says Mark Spinner, CEO, AccessOne. “Understanding that patients need payment options and delivering an array of them are critical capabilities for sustainable financial performance in today’s healthcare operating environment.”

The survey was commissioned by AccessOne and conducted by Big Village from October 4-6, 2023. Big Village surveyed 1,016 adults, and completed interviews were weighted by age, sex, geographic region, race and education to ensure reliable and accurate representation of the total U.S. adult population.

About AccessOne

AccessOne, a leading healthcare fintech company, partners with health systems to provide consumer centric payment tools for the modern patient. From pay-in-full to extended payment plans, our mobile-native pathways make understanding and paying medical bills easy and affordable. Our text-to-pay platform strips out the need to remember usernames, passwords or account numbers, creating a frictionless experience that drives more payments. Our inclusive patient financing solution adds a Care Now, Pay Later component that accepts all patients, meaningfully lowering the financial barriers to receiving high-quality healthcare. AccessOne is reimagining payments for healthcare. Learn more at www.accessonepay.com or connect with us on LinkedIn.

###

Media Contact

For AccessOne:

Kandace Carter