It’s clear that the COVID-19 pandemic has disrupted our healthcare industry. According to McKinsey’s Health System Financial Resilience Survey, 30 percent of finance executives expect their 2020 operating margins to fall 20 percent below original forecasts, and 15 percent of executives do not believe they will have enough days’ cash-on-hand during this pandemic. To help counter this effect, hospitals and health systems are beginning to open their elective surgeries to their communities as an effort to bring cash into the door. Consumers, on the other hand, are in a different mindset.

In his latest thought piece published by Health IT Answers, AccessOne CEO Mark Spinner illustrates a new and emerging patient behavior trend centered around the financial barriers to healthcare caused by the pandemic. Spinner points to a recent survey conducted by ENGINE Insights and commissioned by AccessOne in mid-April that demonstrates this trend:

- 68 percent of consumers are concerned about their ability to pay for general medical expenses this year.

- Among consumers who plan to delay care this year, one in three would consider delaying non-emergency but medically necessary care—like a knee replacement—for up to six months due to cost.

- About one-third also would delay diagnostic tests—like a colonoscopy—for up to six months.

With financial obstacles in the way, consumers are looking for resources. By establishing a proactive financial engagement and communication strategy, hospitals can protect their financial health while ensuring patients receive necessary medical care without fear of cost.

To establish a robust strategy, Mark Spinner shares three tactics all health systems should consider:

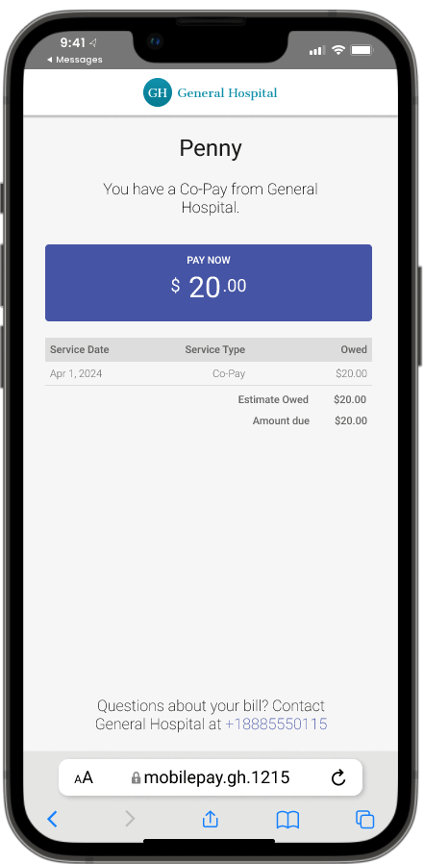

- Ensure all patients benefit from early and seamless patient financial communications. This includes a single contact for financial resources such as payment plan arrangements or cost-of-care and billing inquiries.

- Offer flexibility around payment such as interest free payment plans — regardless of income level. All-inclusive, flexible financing is a vital step toward helping patients feel financially comfortable undergoing a needed procedure.

- Double down on contact with surgery patients whose accounts are past due. For those who established a payment plan prior to COVID-19 and have suddenly stopped their payments, engage these patients and offer practical solutions to meet their needs.

For more details on these tactics and how to develop targeted communications for vulnerable populations, read the full article here: Why Non-Emergency Surgery Volumes Could Depend on Early Financial Engagement.