Rising out-of-pocket healthcare costs has forced both healthcare providers and patients to confront the growing challenge of paying and receiving medical care. The reality is that the inability to afford care is no longer a lower-income problem. Healthcare costs are now a major stressor for both mid- and upper-income individuals and families.

This problem affects both patients who are unable to pay their medical bills, as well as healthcare providers struggling to stay afloat when they are not receiving timely payments. As Mark Spinner, CEO of AccessOne explained to Medical Economics, “the majority of the country has a [healthcare] affordability problem now. People with jobs, with families, with mortgages and auto loans, people who are credit worthy”.

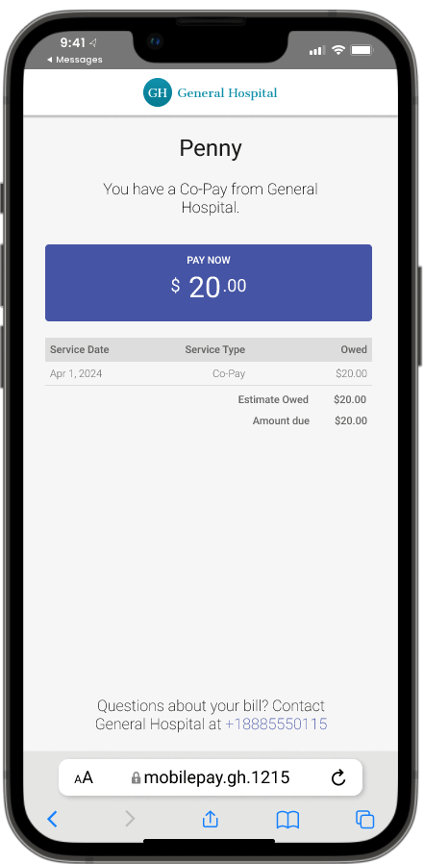

In order to solve this issue, it is increasingly important for healthcare providers to introduce in how they handle patient financing and billing. There are several different payment plan strategies that healthcare providers can use such as personalized financing. Similar to a store brand charge account an individual might receive at Home Depot or Nordstrom, patients can pay off their balances with monthly payments on their own terms and healthcare providers receive the cash up-front.

Using third-party financers can also help bridge the divide of patient financing. As part of its suite of services, AccessOne offers flexible patient financing that includes both low- and zero-interest financing plans. When patients and healthcare providers move towards collaborative financing plans such as these, they are much more likely to experience positive outcomes for both parties