Survey finds families struggle with limited payment options for medical bills; twice as likely to have accounts sent to collections

CHARLOTTE, NC — Twenty-seven percent of households with children are likely to delay medical care because they can’t afford to pay for it, according to a new survey commissioned by AccessOne, a leading provider of patient financing options designed to help patients manage their healthcare costs. The survey, conducted by ORC International, found that despite higher deductibles and out-of-pocket expenses, patients often have little knowledge about medical costs or how to pay for them.

“The high cost of healthcare has become a mass-market problem for the American consumer. The fact that so many families are delaying care due to fear of affordability will have lasting negative impact on population health, total cost of medical care for employers and health plans, and providers financial ratios,” said Mark Spinner, CEO of AccessOne. “Healthcare providers can support their communities and their financial wellbeing by proactively offering flexible financing options, while also reducing organizational bad debt.”

Additional Key Findings:

- Families are twice as likely to have their accounts sent to collections. Over one-fifth of families who had trouble paying their medical bill reported that their accounts had been sent to collections.

- More than half of respondents were concerned about their ability to pay a medical bill of less than $1,000; with 35 percent being concerned about paying a bill that totals less than $500 – 20 times less than the average healthcare balance of a person in the U.S.

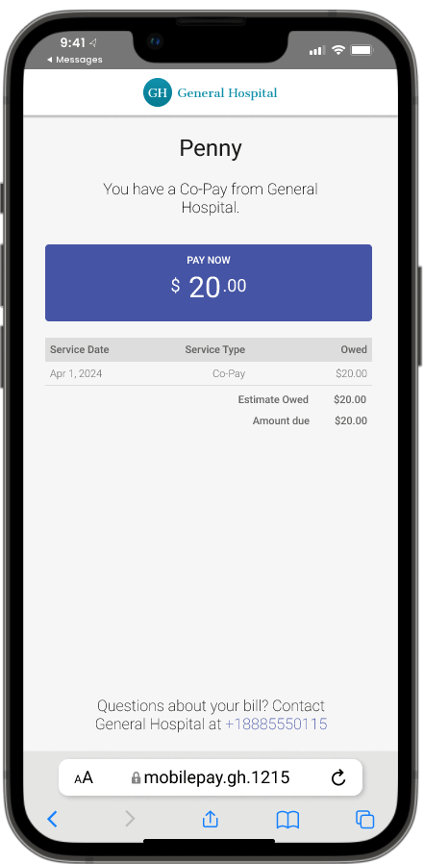

- Only 21 percent of respondents said their healthcare providers have spoken to them about available patient financing options in the past two years.

- Fifty-five percent of those surveyed said they prefer to discuss healthcare costs and financing options before care of service is delivered.

- Fifty-four percent of those surveyed said they would use a no-interest financing option for a balance of $1,000 or less, and 57 percent said availability of a no-interest finance option is important or very important in evaluating a provider.

To see the full report, click here.

Methodology

The survey was commissioned by AccessOne and conducted by ORC International from August 13 to 15, 2018. ORC International surveyed 693 people with at least $35,000 in annual household income. Completed interviews were weighted by age, sex, geographic region, race and education to ensure reliable and accurate representation of the total U.S. adult population