Patients’ perception of healthcare payments is falling fast

Each year Elavon, the multi-industry payments giant, releases an insightful annual healthcare payments report. The 2021 report highlights a troubling patient sentiment trend hospitals, health systems, and provider groups of all sizes need to address now to prevent further loss of patient revenue.

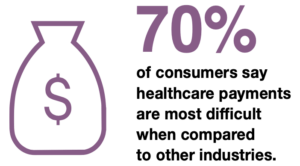

Check out this troubling year-over-year growth: nearly 48% of consumers felt healthcare payments were the most difficult to make compared to other industries. A year later that number was 70% of respondents.

That would troubling on its own. But, add to this patients are increasingly responsible for a greater portion of the cost of care (upwards of 30%), everyday life has become more expensive thanks to inflation, and you have a compounding effect of powerful forces headed in opposite directions.

What happened to patient payments between 2019 and 2020?

The question that begs to be answered is: what happened to healthcare payments from 2019 to 2020 to drive this massive change in patient sentiment? Why do the vast majority of patients perceive healthcare to be the most difficult of all industries to do business with?

*Hint*

This one is refreshingly not COVID related.

The answer is nothing. Absolutely nothing happened. That’s the problem.

Healthcare payments didn’t become worse, but they didn’t improve either. They didn’t keep pace with consumer preferences for convenient commerce, as nearly every other industry did.

Patient expectations shifted dramatically because of Amazon, Venmo, Shopify, ApplePay, and the like.

E-commerce has exploded, growing 129% year-over-year and 149% since April 2020, when the COVID pandemic began. Quarantines and lockdowns dramatically shifted consumer behavior; m-commerce, aka mobile payments, is projected to represent 54% of all e-commerce transactions.

It’s clear to see why healthcare payments are the most difficult by comparison; anywhere, day or night, e-commerce enables online payments from computers and phones via intuitive, modern methods that are suddenly unavailable when it’s time to pay a co-pay.

“Healthcare payments companies didn’t become worse, but they didn’t improve either. They didn’t keep pace with consumer preferences for convenient commerce, as nearly every other industry did.”

Patients on the other hand are offered paper statements, interactive voice response (IVR) systems, and particularly unique to healthcare, they are most often routed to online payment portals. All these options exist in a pre-smartphone world representing a significant departure from the convenient payment experiences these patients enjoy as consumers in their everyday lives.

Will healthcare payments join the new age?

The incumbent healthcare payments companies began years ago as print houses, mailing paper statements. Now, they find themselves trapped by their own business models, unable to harness new technology that would destroy existing paper-based revenue. These companies are left with only two options when faced with these digital payment trends; resist or reject.

Resistance to convenient commerce appears as an electronic payment portal with a required login identifier only printed on the mailed paper statement. Rejection is how patients perceive healthcare payments, reflected in their deteriorating 48% to 70% sentiment that healthcare payments are the most difficult.

Simplifying Patient Payments

AccessOne is new to the patient payments space, without the baggage of a legacy business to sustain.

AccessOne’s MobilePay patient payments solution leverages the latest in SMS text technology to align to consumer expectations for a delightful payment experience that supports both the patient and the healthcare organization. MobilePay is built to remove friction from the payment experience, with close consideration given to m-commerce trends. It maximizes both the patient experience and payment performance.

Across the MobilePay customer base, we’ve seen a:

- 20-30% increase in overall patient revenue collected

- 25+% reduction in paper statements and call center call volume

- 37% of all MobilePay payments made on the very first notification delivered to a patient

- 80% of payment funds received before the provider organization prints its first paper statement

From the beginning, our goal has been to remove unnecessary stumbling blocks along the payment journey, while remaining safe, secure and compliant.

MobilePay is not an app to download and there is no clumsy portal required to log into. Patients receive MobilePay messages on their mobile devices, ready for payment with one touch. All the payment and statement details required for a patient to feel confident in paying their balance are presented clearly and concisely.

MobilePay is not tethered to a paper statement, our customers reduce paper statement and call center costs by more than 25%.